Downtime: The silent threat that many manufacturers underestimate.

In the manufacturing industry, time has an echoing impact. A minute of engineering downtime isn’t just a passing moment. It represents missed delivery windows, stalled product launches, and disrupted supply chains. All of this can build up and lead to millions of dollars in lost revenue. As a growing industry with over $14 trillion in revenue, according to a 2025 Statista report, many small manufacturing companies simply can’t afford the losses downtime presents. The competition is simply too steep. Even so, downtime is not just an occasional setback; it’s a recurring challenge that shapes daily operations.

To better understand the scale and impact, we surveyed 200 U.S. professionals in engineering and operations roles at organizations with annual revenue under $500 million. The findings revealed how often engineering downtime occurred, what caused it, how long it lasted, and the ways it influenced both financial performance and customer relationships. They also highlighted where companies saw opportunities to prevent failures before they reached production.

Key Takeaways

- 52% said an hour of downtime cost their facility $50,000 or more on average.

- 21% reported their largest downtime event in the past year cost $250,000 or more.

- 47% estimated downtime consumed three percent or more of their company’s annual revenue.

- 45% confirmed they had to delay or cancel a product launch due to downtime.

- 54% experienced three or more downtime events lasting an hour or more in the past year.

- 60% of teams using simulation tools reported identifying potential failures before production, though 40% also cited implementation time as a barrier.

Engineering Downtime Is More Common Than You Think

Even short disruptions could derail production schedules, but many manufacturers said downtime was a recurring feature of daily operations. In the past year, more than half of respondents reported at least three major interruptions lasting an hour or longer. For suppliers managing slim margins and tight delivery windows, repeated stoppages the resulting engineering downtime meant missed deadlines and strained customer relationships.

Overall, 54% reported three or more downtime events in the past year, showing that interruptions were routine for many firms rather than isolated setbacks. Larger organizations felt the impact most strongly: among companies with $250M to $499M in annual revenue, nearly two-thirds reported at least three incidents. Mid-market suppliers operating at higher volumes were particularly vulnerable, with each lost hour translating into greater financial consequences.

Smaller companies experienced fewer disruptions. Nearly half of businesses under $50M in annual revenue reported only one or two events, suggesting that scale played a role in exposure. As companies grow bigger, the more complex their operations become, leading to more opportunities for oversight and downtime. While small operations face different challenges of their own, frequent downtime was not one of them.

What’s Causing the Most Engineering Downtime?

When systems went offline, the root causes varied widely, but mechanical and software issues led the list. Combined, they accounted for more than half of all recent incidents. Environmental factors, such as power outages or weather, also contributed, while delays in materials and supply chain disruptions added further complications.

Supply chain disruptions are also a regular occurrence among manufacturers outside of this survey. Even though they became more common during the pandemic’s uncertainty, they continue to be the norm for nine out of ten manufacturers, according to a 2024 McKinsey survey.

Mechanical breakdowns were the most common single cause, reported by nearly one in three respondents. These failures often required parts replacement and extended recovery times, leading to lost production hours and unexpected costs. Software and systems errors were the next most frequent, underscoring the growing reliance on digital infrastructure.

The picture shifted slightly when looking at regions. Respondents in the Midwest reported higher rates of mechanical failures, while environmental causes were more prevalent in the South. While many manufacturing activity takes place in the Southeast due to desirable labor and business environments, the disruptions caused by the weather can present more risk than those located elsewhere in the country. Even though the financial consequences of both mechanical failures and environmental disruptions were similar, the regional differences represent how something seemingly unrelated, like geography and local infrastructure, can significantly impact companies later down the line.

How Long Does Downtime Last?

While many manufacturers contained stoppages within a few hours, others reported their engineering downtime stretched into extended outages that magnified costs and delays. The longer the delay lasted, the more disruptive it became.

Most respondents reported their most recent downtime lasted between one and five hours, with 44% pointing to one to two hours and 29% to three to five hours. These findings showed that interruptions often extended well beyond a quick reset or repair, instead consuming a large part of a working shift.

Extended outages, while less common, created significant disruption. Eleven percent said their last downtime lasted six hours or more, a stretch that could put major orders behind schedule and lead to cascading effects throughout supply chains. Larger manufacturers were more likely to experience these extended stoppages, which again reflects that larger manufacturers are more likely to experience outages due to their complex operations.

The Real Cost of Engineering Downtime

When operations stalled, the financial toll was significant. With manufacturers producing nearly $3 trillion in 2025 according to World Bank Group estimates, even brief interruptions can add up, leading to thousands, if not millions, of dollars in lost output. As a result, manufacturers have to cut into their budgets. When asked to estimate how much they lost due to downtime, respondents found that the costs scaled quickly as incidents accumulated.

One in three respondents estimated that downtime consumed three to five percent of their company’s annual revenue, while another 14% reported losses of six percent or more. For firms with hundreds of millions in annual revenue, that level of loss translated to millions of dollars in missed output and delayed shipments.

Smaller firms were less likely to report high-percentage losses, though the financial strain was still significant. Even a one or two percent revenue hit could challenge businesses operating on narrow margins. These results underscored that while the scale of losses varied, no segment of the industry was immune to the cost of unexpected downtime.

Customer Trust at Stake

The effects of engineering downtime went beyond financial losses. For many manufacturers, repeated stoppages led to delayed shipments, rescheduled projects, and strained client relationships. These consequences don’t just temporarily affect a company’s earnings. It can have lasting consequences for reputation and competitiveness.

Nearly half of respondents said downtime had forced their company to delay or cancel a product launch. For suppliers, these disruptions not only meant missed revenue but also damaged trust with customers relying on precise delivery schedules. Delays at one tier of production often reverberated downstream, creating challenges for multiple partners in the supply chain.

Larger organizations were more likely to report these setbacks, reflecting how the ripple effects grew as operations scaled. In industries where reliability was a deciding factor in long-term contracts, maintaining consistent output was essential to protecting client relationships. Ultimately, the findings showed that downtime was as much a reputational risk as it was a financial one.

What’s Holding Teams Back From Using Simulation More?

While not all causes of downtime are within our power of control, simulation tools can be a way to identify and prevent failures before production. Yet, adoption was not universal among respondents. Instead, many pointed to several barriers that limited wider use, ranging from resource constraints to organizational priorities. These challenges showed why even companies that recognized the value of simulation struggled to make it a consistent part of operations.

The most common barrier was the time required to implement, cited by 40% of respondents. Even when the long-term benefits were clear, the initial investment of staff hours and integration slowed adoption. Another 22% cited a lack of trained staff, suggesting that workforce readiness was just as important as access to the tools themselves.

Cost was another hurdle, with 18% saying software or licensing fees held their companies back. Smaller firms, in particular, were more sensitive to the upfront expense, while larger organizations were more likely to struggle with the internal resources needed to train staff and implement effectively. Together, these findings indicate that while simulation has the power to eliminate engineering downtime and manufacturers are still interested in it, they still may not have the capacity to implement it.

The Bottom Line on Engineering Downtime

The findings revealed that downtime was both common and costly, affecting manufacturers across industries and company sizes. Interruptions reduced output, strained budgets, and eroded customer trust, making them a persistent challenge for engineering and operations teams.

That said, manufacturers still have hope. The data also pointed to opportunities for improvement. Investments in training, staffing, and simulation tools helped reduce the frequency and duration of downtime, though barriers to adoption remained. Manufacturers that addressed these hurdles developed better reliability and resilience, especially as supply chains grew more complex.

For manufacturers, reducing downtime was not only a financial imperative but also a way to safeguard relationships and maintain a competitive edge.

Reduce Engineering Downtime with Simulation-Driven Reliability

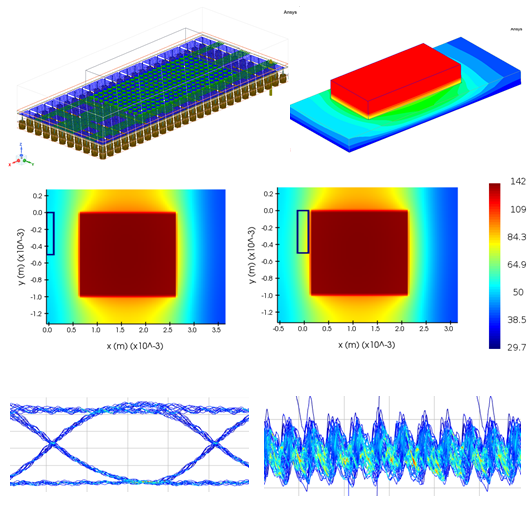

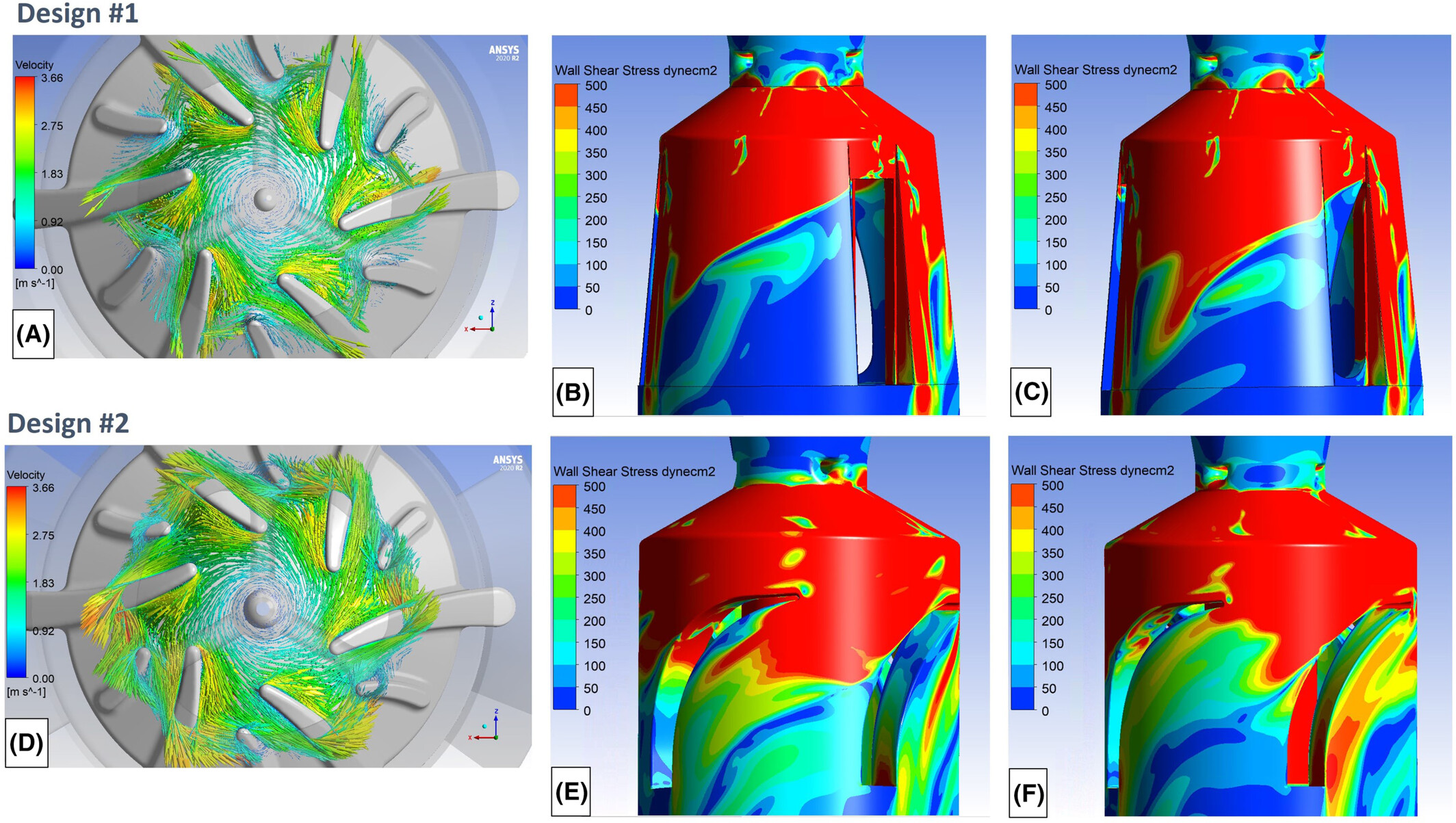

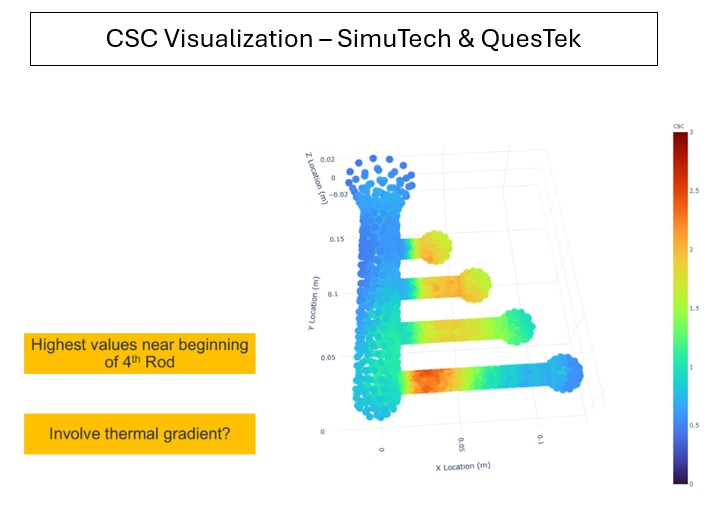

At SimuTech Group, we help teams pinpoint failure modes, quantify risk, and validate fixes before they hit the floor using FEA, CFD, digital prototypes, and reliability workflows to harden designs and processes. Whether you’re prioritizing root-cause corrections, testing “what-if” scenarios, or building a prevention playbook, our experts can help cut unplanned outages and protect revenue.

Contact us today to turn downtime data into action, and keep production on schedule.

Methodology

We surveyed 200 U.S. professionals working in engineering and operations roles at organizations with annual revenue under $500 million. Respondents represented a range of industries, including automotive, aerospace, electronics, and energy.

Subgroup insights are reported only when at least 30 respondents fell into a given category, such as industry, company revenue, role, or region. Totals may not always equal 100% due to rounding.

About SimuTech Group

SimuTech Group is the largest provider of Ansys engineering simulation software in North America. The company supports organizations across industries with advanced simulation tools, training, and consulting services designed to improve performance, reduce costs, and prevent failures before they occur. By combining technical expertise with practical implementation, SimuTech helps engineering and operations teams strengthen reliability and drive innovation.

Fair Use Statement

We invite you to share this research for noncommercial purposes. Please include a link back to this page so readers have access to the full findings and methodology.